When it comes to long-term investing, the debate between active and passive strategies is ongoing. Two popular approaches often compared are selling puts and the classic buy-and-hold strategy. Both have their merits, but which one has historically provided better returns with manageable risk? In this article, we dive into the backtested results of these two strategies to see which one comes out on top.

Understanding the Strategies

Selling Puts:

Selling put options is a strategy where an investor agrees to buy a stock at a predetermined price (the strike price) if the stock falls to or below that price by the option’s expiration date. In return, the investor collects a premium upfront. The primary goal is to generate income through these premiums while potentially acquiring stocks at a discount.

Pros:

- Generates regular income through option premiums.

- Potential to buy stocks at a lower price than the current market value.

Cons:

- Requires margin, which could tie up capital.

- Limited upside potential if the stock doesn’t fall to the strike price.

Buy-and-Hold:

The buy-and-hold strategy is as straightforward as it sounds. Investors purchase stocks and hold onto them for an extended period, regardless of market fluctuations. The goal is to benefit from long-term capital appreciation, dividends, and compounding returns.

Pros:

- Simplicity and ease of execution.

- Historically proven to deliver solid long-term returns.

Cons:

- Can experience significant drawdowns during market downturns.

- No active income generation, relying solely on capital appreciation and dividends.

Methodology

- Start with 100K

- Simulate selling SPY puts

- Benchmark against SPY

- Experiment with different deltas

- Experiment with different durations

The data

- Starting at 6/1/2010 (when weeklies were introduced)

- Alpha Avantage as data provider

- End of day SPY data (8:45PM EST)

- Hold until expiration and settle to cash

The benchmark

On June 1, 2010, the SPY (S&P 500 ETF) closed at $107.53. With $100,000 in cash, you could have purchased approximately 929.97 shares of SPY. By August 30, 2024, the SPY closed at $563.68, meaning those 929.97 shares would be worth $524,207.20, not including any dividends received during that period.

The results

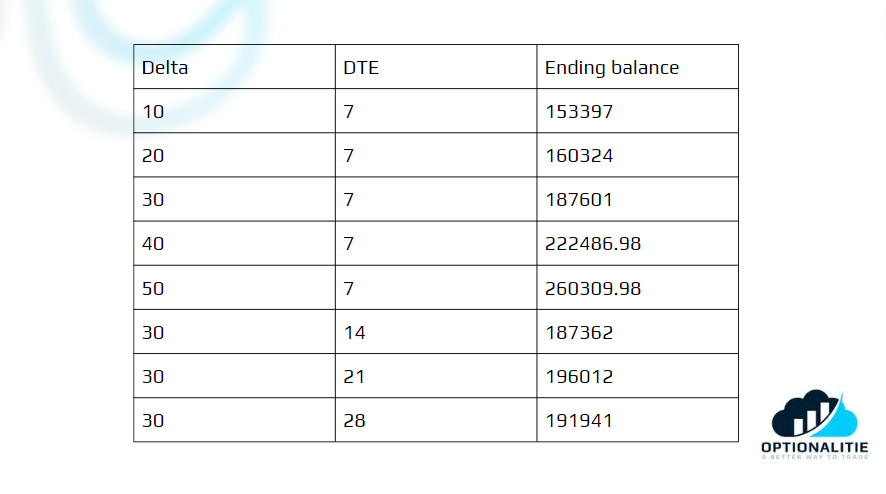

Using the backtesting feature on Optionalitie, we generated the following set of backtests. We have links to all of the results on platform, all of which are constantly being updated as the backtests are still live.

Selling puts greatly underperformed buy and hold in all scenarios. Selling puts grew the account from the initial $100,000 to anywhere from $150,000 to $260,000 whereas buy and hold grew it from $100,000 to over $524,000. The higher the delta puts you sold, the better your results would be. This is intuitive because the higher delta puts simulated going long the stock and was less reliant on time premium running off.

Why does put selling underperform buy and hold?

The market is either going up, going down or going sideways. Selling puts only marginally outperforms when it is going down and sideways, but significantly underperforms when it is going up. Since we have been in a long bull market during the back testing period, it spent most of the time greatly underperforming while buy and hold took advantage of all of the price appreciation. The following data proves this point

You can see that in the drawdown, selling puts only slightly outperforms buy and hold for a couple of percentage points. However it drastically underperforms in the recovery, by anywhere from 50% to 100%. The results are mixed in the sideways period.

What if we used a margin account?

At the beginning of the backtests, the simulator used to sell 9 lots of SPY puts since it had enough cash to sell those puts. Toward the end, the simulator can only sell 2-3 puts at a time due to the amount of cash required to initiate the position in a cash account. We simulated using a margin account where you can sell puts on leverage.

Although the results were significantly better than selling in a cash account, you can see that the backtests had many sharp drawdowns, very similar to the draw downs if you were buy and hold, but did not have dramatic recovers like the buy and hold strategies did.

In conclusion

Buy and hold outperforms consistently selling puts because the significant price appreciation in a bull market far exceeds the income generated from option premiums.

Cash-secured puts become increasingly cash inefficient as the price of the underlying asset rises.